Investigate data quality management platform begins transforming customer and organisation data quality on day-one, enabling financial institutions in their pursuit of data-driven business growth.

Read MoreFor many super funds, combining the best elements of two or more funds is an attractive venture, and in some cases, an inevitable one, with evidence and industry pressure behind it. APRA’s heatmaps still show 18 chronically underperforming super funds, and analysis from Super Consumers Australia estimates that mergers are leaving the average member $15,000 better off in retirement, primarily from fee-savings.

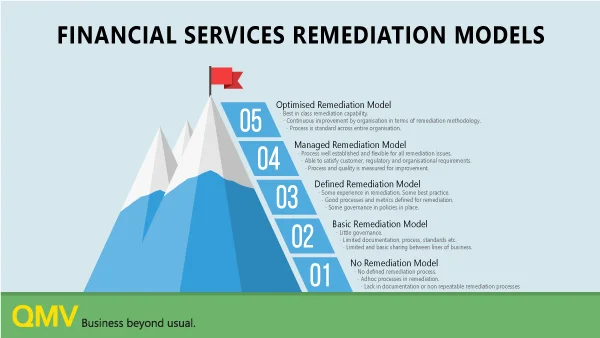

Read MoreThe ability to identify, scope and remediate customer account errors has become a key regulatory item in financial services. These issues can result in breaches and are thus “non-negotiable” with regulators.

Depending on the scale of remediation events, personnel and funding tends to swell and subside. The deeper you look, the more people involved, the more money you throw at it, the more errors you will find.

Read MoreCustomers expect financial institutions to correctly calculate their financial position and to know exactly who they are. No one wants to be at a loss, especially when it is someone else’s fault. A miscalculation, an administrative mistake, lack of insurance coverage, or other errors, can cause customers to feel wronged, robbed, not cared about or even marginalised.

Read MoreMost executives and most CEOs recognise that data is their most valuable asset, yet a very few actually understand and invest in it. Often no one actually knows who's accountable for it because data often isn't a business unit. Data is needed and held by every part of the business.

Read MoreThe Hayne Royal Commission raised a question mark over the quality of customer data held by financial institutions and emphasised that action after the fact via costly data remediation events was not good enough. In a post royal commission world, it is important to know why customer data is so prone to error.

Read MoreAt QMV, we believe that robust data quality management practices not only increase member engagement but also help solidify members’ trust in the company. Recognising a growing demand for more control and customisation around reporting, QMV are very pleased to present the latest version of Investigate featuring some significant enhancements that reaffirms our commitment to meeting our customer’s needs for superior data quality management.

Read MoreEven though reputable third-party providers have data governance frameworks and performance metrics in place, it is important to recognise inherent bias and that data quality governance is not often their core capability. Data quality must be independently and routinely monitored and validated. If access to the data can be obtained, an independent audit can often uncover widespread error for which regulatory breach and costly remediation is a legitimate risk.

Read MoreTo better support Investigate clients with coronavirus related measures affecting superannuation administration, QMV has released a data assurance content pack dedicated to staying on top of the Coronavirus Economic Response Package.

Read MoreIn response to the ongoing COVID-19 pandemic, the Australian government has passed legislation to allow affected individuals early access of up to $10,000 from their superannuation. Due to the fast-paced nature of the crisis, superannuation funds and administrators are working vigorously provide members with the services and information they need.

Read MoreEstablished life insurers currently face the biggest challenge of their reign keeping pace with today’s rate of technological change. Increasingly, better informed customer bases combined with more data than ever before, legacy systems and heightened regulatory scrutiny make transitioning to more innovative, value-driven systems highly challenging.

Read MoreQMV is pleased to release a data assurance content pack dedicated to helping trustees to monitor compliance with the Putting Members’ Interest First reforms. This pack complements existing definitions and rules content available across Investigate including the recent Protecting Your Super data assurance content pack.

Read MoreQMV is proud to exhibit at ASFA 2019 Australia's flagship event for superannuation professionals and associated service providers. We collaborated with Tonic Alchemy to develop a range 100% natural tonics with super healthy properties to help you get through the three days with a kick! Visit QMV at stand 24 and take a shot or two. You might need it!!

Read MoreThe digital age of customer information opens vast opportunities for financial institutions from providing tailored solutions, omnichannel experience and innovative avenues to communicate with customers.

Read MoreTesting of fintech products and platforms is increasingly a mix of human and automated testing thanks to advancements in technology, machine learning and artificial intelligence. The movement away from manual work can allow financial services organisations to boost product development, improve efficiencies, enhance quality and mitigate risk.

Read MoreQMV is pleased to release a data compliance assurance content pack dedicated to helping funds adhere to the Protecting Your Super reforms. This pack complements existing definitions and rules content available across QMV’s data quality management platform, Investigate.

Read MoreThe Hayne Royal Commission rightfully and very publicly raised a question mark over the quality of customer data held by financial institutions. It also highlighted that data remediation – the cleansing, organisation and migrating of data – after costly and often lengthy investigation, warrants greater focus.

Read MoreData remediation activities in financial services will never cease. The best that can be achieved is significantly reducing the frequency and scope of remediations over time. This paper is a brief discussion of the triggers, execution and controls associated with data remediation events and can be applied to superannuation, wealth management, banking and insurance.

Read MoreMany data remediation programs are only started after an issue being brought to light by a customer or group of customers: often upon investigation, this gives rise to a slew of other issues that may have been impacting thousands of customers across several years.

Read More