The Prudential Standard CPS 230 sets out stringent requirements for operational risk management in the superannuation industry. By implementing a robust framework and adhering to these requirements, APRA-regulated entities can effectively manage operational risks, maintain the continuity of critical operations, and enhance their resilience to disruptions. This, in turn, contributes to the stability and integrity of the superannuation industry, promoting trust and confidence from customers, stakeholders, and regulators alike

Read MoreOften, large scale data activities like generating annual statements requires data being transferred between systems and external providers. This can leave superannuation administrators exposed if they are experiencing data quality issues leading to loss of reputation and increased rectification costs.

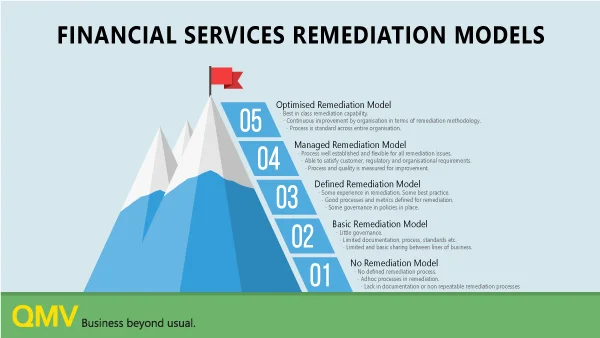

Read MoreMost organisations don’t plan for remediation, their approach is often disjointed, reactive and inefficient. As leaders in remediation, we understand the importance of accuracy, timeliness and communication. At QMV, we believe specialised remediation experts with developed processes, calculation models and the right technology can fast-track remediation work, deliver quality outcomes and reduce costs.

Read MoreA high-performance mentality that promotes collaboration and information exchange is fundamental to realising a fund’s key objectives like developing tailored strategies and products, better meeting member expectations and various uplifts across automations, data quality, emerging technologies and compliance.

Read MoreThere has never been more reliance and importance on data to provide administration of consumer products effectively and efficiently. The Optus data breach is a significant and public example of data may be used for fraudulent purposes, however, there is an ongoing risk that must be mitigated to ensure that, regardless of scale or publicity, consumer interests are protected as much as possible.

Read MoreAs the industry moves away from ad-hoc or project-based optimisations to more holistic and integrated digital capability, the fund needs ‘mastermind’ thinkers on the transformation program ideally with the trifecta of technology, data and superannuation pedigree.

Read MoreInvestigate data quality management platform begins transforming customer and organisation data quality on day-one, enabling financial institutions in their pursuit of data-driven business growth.

Read MoreFor many super funds, combining the best elements of two or more funds is an attractive venture, and in some cases, an inevitable one, with evidence and industry pressure behind it. APRA’s heatmaps still show 18 chronically underperforming super funds, and analysis from Super Consumers Australia estimates that mergers are leaving the average member $15,000 better off in retirement, primarily from fee-savings.

Read MoreThe ability to identify, scope and remediate customer account errors has become a key regulatory item in financial services. These issues can result in breaches and are thus “non-negotiable” with regulators.

Depending on the scale of remediation events, personnel and funding tends to swell and subside. The deeper you look, the more people involved, the more money you throw at it, the more errors you will find.

Read MoreCustomers expect financial institutions to correctly calculate their financial position and to know exactly who they are. No one wants to be at a loss, especially when it is someone else’s fault. A miscalculation, an administrative mistake, lack of insurance coverage, or other errors, can cause customers to feel wronged, robbed, not cared about or even marginalised.

Read MoreThe Hayne Royal Commission raised a question mark over the quality of customer data held by financial institutions and emphasised that action after the fact via costly data remediation events was not good enough. In a post royal commission world, it is important to know why customer data is so prone to error.

Read MoreMillions of employees have had salaries and working hours reduced or stopped suddenly due to changes in employment conditions. According to the Budget Overview the Government's JobKeeper payments have supported over 3.8 million workers with the payment of $60 billion in wages.

Read MoreEven though reputable third-party providers have data governance frameworks and performance metrics in place, it is important to recognise inherent bias and that data quality governance is not often their core capability. Data quality must be independently and routinely monitored and validated. If access to the data can be obtained, an independent audit can often uncover widespread error for which regulatory breach and costly remediation is a legitimate risk.

Read MoreMillions of employees have or will have salaries and working hours reduced or stopped suddenly due to changes in employment conditions. Current estimates indicate that the government’s proposed JobKeeper payment will help pay the wages of 6.7 million workers (source ABC).

Read MoreIn the last decade, the arrival and development of the ‘cloud’ has had a profound impact on the financial services sector, both in Australia and globally. I’m not talking about the cloud Grampa Simpson is yelling at but referring to the term ‘cloud computing’.

Read MoreContact centres are a hot topic across financial services as institutions look to dominate the customer experience race. The drivers come as a result of higher customer expectations, competitive advantage and the need to rebuild trust post royal commission.

Read MoreEstablished life insurers currently face the biggest challenge of their reign keeping pace with today’s rate of technological change. Increasingly, better informed customer bases combined with more data than ever before, legacy systems and heightened regulatory scrutiny make transitioning to more innovative, value-driven systems highly challenging.

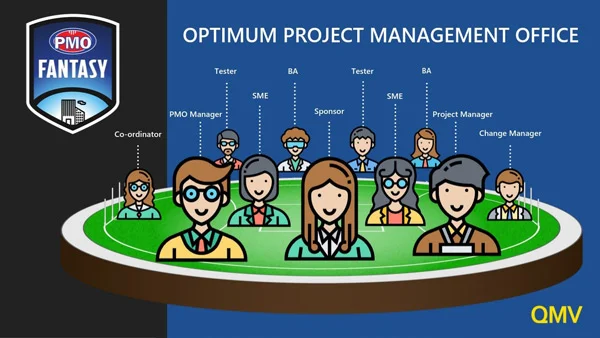

Read MoreSometimes a rag-tag bunch of misfits that have been thrown together join forces and deliver a program of work. When it happens, it can be magical but it’s a rare thing.

You don’t always get to pick and choose. Your strike team might be assembled but you still need a command crew for the shuttle. Here we look at some of the traits you, as a PMO manager should be seeking out to ensure you build a delivery team positioned for success.

Read MoreThe digital age of customer information opens vast opportunities for financial institutions from providing tailored solutions, omnichannel experience and innovative avenues to communicate with customers.

Read MoreTesting of fintech products and platforms is increasingly a mix of human and automated testing thanks to advancements in technology, machine learning and artificial intelligence. The movement away from manual work can allow financial services organisations to boost product development, improve efficiencies, enhance quality and mitigate risk.

Read More