The Prudential Standard CPS 230 sets out stringent requirements for operational risk management in the superannuation industry. By implementing a robust framework and adhering to these requirements, APRA-regulated entities can effectively manage operational risks, maintain the continuity of critical operations, and enhance their resilience to disruptions. This, in turn, contributes to the stability and integrity of the superannuation industry, promoting trust and confidence from customers, stakeholders, and regulators alike

Read MoreOften, large scale data activities like generating annual statements requires data being transferred between systems and external providers. This can leave superannuation administrators exposed if they are experiencing data quality issues leading to loss of reputation and increased rectification costs.

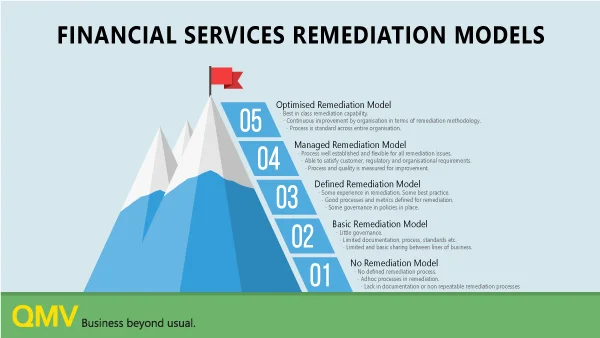

Read MoreMost organisations don’t plan for remediation, their approach is often disjointed, reactive and inefficient. As leaders in remediation, we understand the importance of accuracy, timeliness and communication. At QMV, we believe specialised remediation experts with developed processes, calculation models and the right technology can fast-track remediation work, deliver quality outcomes and reduce costs.

Read MoreA high-performance mentality that promotes collaboration and information exchange is fundamental to realising a fund’s key objectives like developing tailored strategies and products, better meeting member expectations and various uplifts across automations, data quality, emerging technologies and compliance.

Read MoreThere has never been more reliance and importance on data to provide administration of consumer products effectively and efficiently. The Optus data breach is a significant and public example of data may be used for fraudulent purposes, however, there is an ongoing risk that must be mitigated to ensure that, regardless of scale or publicity, consumer interests are protected as much as possible.

Read MoreAs the industry moves away from ad-hoc or project-based optimisations to more holistic and integrated digital capability, the fund needs ‘mastermind’ thinkers on the transformation program ideally with the trifecta of technology, data and superannuation pedigree.

Read MoreInvestigate data quality management platform begins transforming customer and organisation data quality on day-one, enabling financial institutions in their pursuit of data-driven business growth.

Read MoreFor many super funds, combining the best elements of two or more funds is an attractive venture, and in some cases, an inevitable one, with evidence and industry pressure behind it. APRA’s heatmaps still show 18 chronically underperforming super funds, and analysis from Super Consumers Australia estimates that mergers are leaving the average member $15,000 better off in retirement, primarily from fee-savings.

Read MoreThe ability to identify, scope and remediate customer account errors has become a key regulatory item in financial services. These issues can result in breaches and are thus “non-negotiable” with regulators.

Depending on the scale of remediation events, personnel and funding tends to swell and subside. The deeper you look, the more people involved, the more money you throw at it, the more errors you will find.

Read MoreCustomers expect financial institutions to correctly calculate their financial position and to know exactly who they are. No one wants to be at a loss, especially when it is someone else’s fault. A miscalculation, an administrative mistake, lack of insurance coverage, or other errors, can cause customers to feel wronged, robbed, not cared about or even marginalised.

Read MoreThe Hayne Royal Commission raised a question mark over the quality of customer data held by financial institutions and emphasised that action after the fact via costly data remediation events was not good enough. In a post royal commission world, it is important to know why customer data is so prone to error.

Read MoreIn the last decade, the arrival and development of the ‘cloud’ has had a profound impact on the financial services sector, both in Australia and globally. I’m not talking about the cloud Grampa Simpson is yelling at but referring to the term ‘cloud computing’.

Read MoreContact centres are a hot topic across financial services as institutions look to dominate the customer experience race. The drivers come as a result of higher customer expectations, competitive advantage and the need to rebuild trust post royal commission.

Read MoreThe Hayne Royal Commission rightfully and very publicly raised a question mark over the quality of customer data held by financial institutions. It also highlighted that data remediation – the cleansing, organisation and migrating of data – after costly and often lengthy investigation, warrants greater focus.

Read MoreQMV is privileged to be nominated in Super Review’s inaugural Superannuation Consultancy of the Year alongside Deloitte and Rice Warner. The winner will be announced at the Super Fund of the Year Awards on 15 August 2019.

Read MoreData remediation activities in financial services will never cease. The best that can be achieved is significantly reducing the frequency and scope of remediations over time. This paper is a brief discussion of the triggers, execution and controls associated with data remediation events and can be applied to superannuation, wealth management, banking and insurance.

Read MoreMany data remediation programs are only started after an issue being brought to light by a customer or group of customers: often upon investigation, this gives rise to a slew of other issues that may have been impacting thousands of customers across several years.

Read MoreTom Seel is the product lead at QMV and has been involved with Investigate since its inception. He is passionate about data and data-centric projects having been involved in numerous data migration and data remediation projects throughout the superannuation industry.

Read MoreQMV recently hosted a panel of insurance and superannuation leaders to discuss the path forward post the royal commission. The purpose of the event was to share initiatives and ideas that will drive an industry-wide transformation around people, process and technology.

Read MoreThe Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry has thrown some light onto the superannuation sector’s conduct while left alone in the dark with the retirement savings of Australians.

Read More