The Prudential Standard CPS 230 sets out stringent requirements for operational risk management in the superannuation industry. By implementing a robust framework and adhering to these requirements, APRA-regulated entities can effectively manage operational risks, maintain the continuity of critical operations, and enhance their resilience to disruptions. This, in turn, contributes to the stability and integrity of the superannuation industry, promoting trust and confidence from customers, stakeholders, and regulators alike

Read MoreOften, large scale data activities like generating annual statements requires data being transferred between systems and external providers. This can leave superannuation administrators exposed if they are experiencing data quality issues leading to loss of reputation and increased rectification costs.

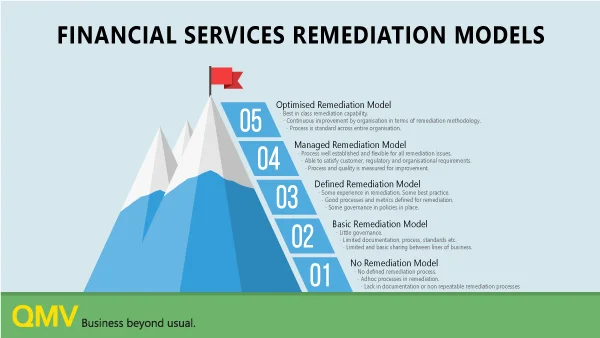

Read MoreMost organisations don’t plan for remediation, their approach is often disjointed, reactive and inefficient. As leaders in remediation, we understand the importance of accuracy, timeliness and communication. At QMV, we believe specialised remediation experts with developed processes, calculation models and the right technology can fast-track remediation work, deliver quality outcomes and reduce costs.

Read MoreA high-performance mentality that promotes collaboration and information exchange is fundamental to realising a fund’s key objectives like developing tailored strategies and products, better meeting member expectations and various uplifts across automations, data quality, emerging technologies and compliance.

Read MoreThere has never been more reliance and importance on data to provide administration of consumer products effectively and efficiently. The Optus data breach is a significant and public example of data may be used for fraudulent purposes, however, there is an ongoing risk that must be mitigated to ensure that, regardless of scale or publicity, consumer interests are protected as much as possible.

Read MoreAs the industry moves away from ad-hoc or project-based optimisations to more holistic and integrated digital capability, the fund needs ‘mastermind’ thinkers on the transformation program ideally with the trifecta of technology, data and superannuation pedigree.

Read MoreInvestigate data quality management platform begins transforming customer and organisation data quality on day-one, enabling financial institutions in their pursuit of data-driven business growth.

Read MoreThe ability to identify, scope and remediate customer account errors has become a key regulatory item in financial services. These issues can result in breaches and are thus “non-negotiable” with regulators.

Depending on the scale of remediation events, personnel and funding tends to swell and subside. The deeper you look, the more people involved, the more money you throw at it, the more errors you will find.

Read MoreCustomers expect financial institutions to correctly calculate their financial position and to know exactly who they are. No one wants to be at a loss, especially when it is someone else’s fault. A miscalculation, an administrative mistake, lack of insurance coverage, or other errors, can cause customers to feel wronged, robbed, not cared about or even marginalised.

Read MoreThe Hayne Royal Commission raised a question mark over the quality of customer data held by financial institutions and emphasised that action after the fact via costly data remediation events was not good enough. In a post royal commission world, it is important to know why customer data is so prone to error.

Read MoreTrustees regularly put their administration up for tender and a successful bid often results in a fund migration. This may be between administrators or just platforms within an administrator. Each migration is unique and presents its own set of challenges and disruptions…

Read MoreQMV is pleased to release a data assurance content pack dedicated to helping trustees to monitor compliance with the Putting Members’ Interest First reforms. This pack complements existing definitions and rules content available across Investigate including the recent Protecting Your Super data assurance content pack.

Read MoreQMV is pleased to release a data compliance assurance content pack dedicated to helping funds adhere to the Protecting Your Super reforms. This pack complements existing definitions and rules content available across QMV’s data quality management platform, Investigate.

Read MoreThe Hayne Royal Commission rightfully and very publicly raised a question mark over the quality of customer data held by financial institutions. It also highlighted that data remediation – the cleansing, organisation and migrating of data – after costly and often lengthy investigation, warrants greater focus.

Read MoreData remediation activities in financial services will never cease. The best that can be achieved is significantly reducing the frequency and scope of remediations over time. This paper is a brief discussion of the triggers, execution and controls associated with data remediation events and can be applied to superannuation, wealth management, banking and insurance.

Read MoreMany data remediation programs are only started after an issue being brought to light by a customer or group of customers: often upon investigation, this gives rise to a slew of other issues that may have been impacting thousands of customers across several years.

Read MoreTom Seel is the product lead at QMV and has been involved with Investigate since its inception. He is passionate about data and data-centric projects having been involved in numerous data migration and data remediation projects throughout the superannuation industry.

Read MoreQMV is extremely honored to have our data quality technology, Investigate named as a finalist for Compliance Innovator of the Year at the 2019 Fintech Business Awards. The nomination is very timely given the findings of the royal commission and the appetite for raising benchmarks across the industry.

Read MoreThe phrase “Offence sells tickets, but defence wins championships” has been used by many great coaches across the sporting landscape. In recent times, this concept has spread from the sporting field into the white-collar world.

Read More